FINOLAB (Tokyo) is drawing attention as a hub for the Fintech community. By connecting startups with experts from various fields, large corporations, investors, and educational institutions, the firm’s initiative fosters co-creation in financial innovation.

In Japan’s pursuit to become a leading asset management center, Fintech—applying cutting-edge information technology to the financial sector—is viewed as a crucial key. Numerous innovative services and new businesses have already emerged domestically, with one place in Tokyo at the forefront of these advancements: FINOLAB, a membership-based community established in 2016. To date, it has attracted 57 startups and 31 corporations and associations, with over 800 individual members. Beginning in 2024, a department of a national university has also set up an office, promoting industry-academia-government collaboration in the field of data science to cultivate talent capable of driving business innovation and addressing social issues.

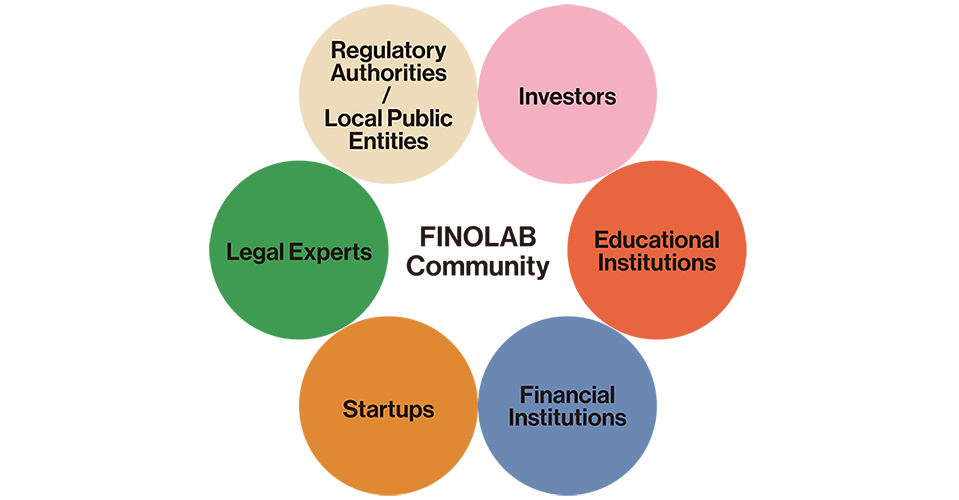

SHIBATA Makoto, head of FINOLAB, describes the community as a “catalyst for transformative change through financial innovation.” Behind this concept lie the unique challenges of the financial sector: namely, the difficulty identifying which products and solutions are feasible, given the numerous, complex, and stringent regulations set in place to safeguard people’s assets. Because of that, the need has arisen for a venue that connects startups and their fresh ideas and technologies with the support of financial and legal professionals. Moreover, collaboration is fostered through the participation of large corporations and local governments as members of the same community, accelerating innovation at a rapid pace. With investors, financial institutions, and educational institutions also involved, FINOLAB aims to establish a network for co-creation in financial innovation—a Fintech ecosystem, so to speak.

By bringing various Fintech stakeholders together, FINOLAB aims to build a world-class ecosystem for financial innovation in Japan.

Shibata explains that by not merely sharing information but engaging in face-to-face discussions through the community, ideas are refined and trust is built, leading ultimately to new business ventures in the real world. Several new businesses have already emerged through FINOLAB’s co-creation activities, including a system to prevent fraudulent bank account openings, developed through a collaboration that brought together a startup’s ideas and technology with support from a major power company and bank, as well as housing loans tailored for employees of startups. A system that facilitates the integration of application programming interfaces (APIs) across different services has already been adopted by a media company in Belgium and a financial group in Brazil, contributing to the development of a highly reliable platform.

Through its own investment fund, FINOLAB also supplies various forms of financial support to promising startups to help them sustain their businesses, assisting them in their preparatory and early stages. It also connects them with outsourced services in such areas as finance and marketing, giving them access to Fintech-related trend analysis and information dissemination. FINOLAB additionally offers support for new business development and talent development programs to large corporations.

Furthermore, recent years have seen a noticeable increase in participation by overseas startups aiming to enter the Japanese market. The pitch contest FINOPITCH, held since 2012, is globally recognized as a gateway to Japan’s Fintech business, with over 200 companies from Japan and abroad having presented so far. Shibata welcomes the fact, noting, “Going forward, we want to further support Japanese startups in expanding overseas.”

SHIBATA Makoto, chief community officer of FINOLAB Inc. and head of FINOLAB. “In the world of Fintech, the trend is shifting from competition to co-creation. This is where FINOLAB has a role to play.”

FINOLAB serves as Japan’s Fintech hub, functioning as a coworking space and shared office. Some startups “graduate” to larger spaces as their businesses grow.

Japan, boasting one of the world’s largest economies, offers many advantages for business development, including a well-established legal framework, infrastructure, and high levels of safety. Social issues such as an aging population and the nation’s efforts to shift to a cashless society simultaneously present business opportunities for Fintech. As Japan advances towards becoming a leading asset management center, all eyes are on the future innovations emerging from the FINOLAB community. “Expectations are high for technology-driven solutions,” said Shibata. “Now, more than ever, is Fintech’s moment to shine.”